Double-edged sword: Fed hikes interest rates again to combat inflation, but it will only deepen our current recession

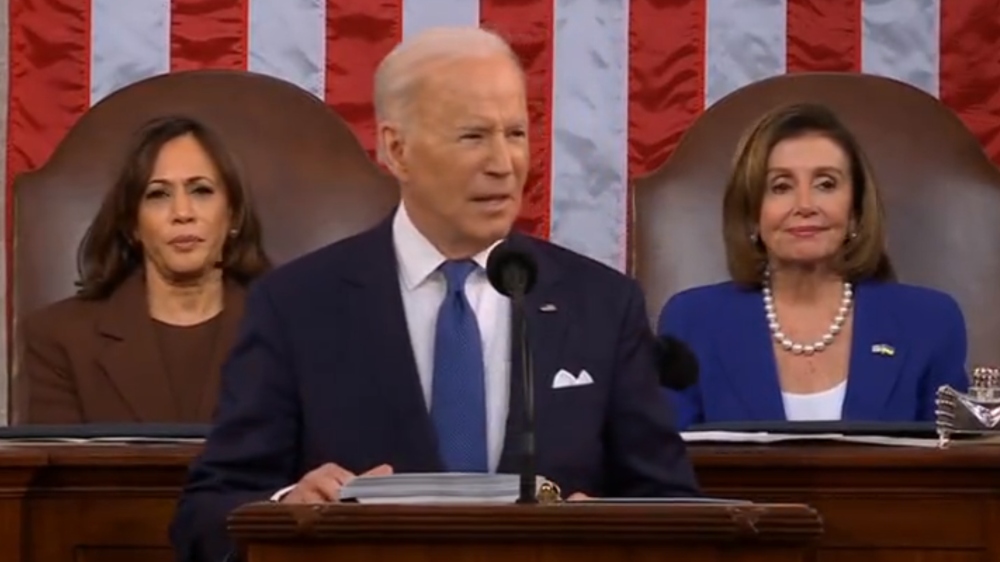

The Federal Reserve has once again raised interest rates in a desperate attempt to combat inflation brought on by Joe Biden's horrific anti-fossil fuel policies and the Democrat-controlled Congress' massive spending packages.

The latest rate action by the Fed is being taken as a means of attempting to control inflation while avoiding a recession, but by definition, the country is already experiencing one.

"The Federal Reserve on Wednesday enacted its second consecutive 0.75 percentage point interest rate increase,"

CNBC reported on Wednesday. "In taking the benchmark overnight borrowing rate up to a range of 2.25%-2.5%, the moves in June and July represent the most stringent consecutive moves since the Fed began using the overnight funds rate as the principal tool of monetary policy in the early 1990s."

The outlet further reported that while Fed fund rates most directly impact what banks charge each other for making short-term loans, the increases also affect a raft of consumer financial products like mortgages, auto loans, and credit cards. The current increase puts the fund rate at its highest since December 2018.

Wall Street was generally anticipating the increase after Federal Reserve officials foreshadowed the move in several statements made since their June meeting. Initially, the markets held gains that were made ahead of the Fed's rate announcement. Central bankers say that using rate hikes to slow down spiraling inflation is more important than slowing the economy, but of course, they would say that, since they don't own businesses or work in a job that requires robust customer purchases.

CNBC noted that in a statement following its meeting, the rate-setting Federal Open Market Committee cautioned that “recent indicators of spending and production have softened.”

“Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low,” the committee noted further in language that sounded very similar to that used in a June statement. Officials once again said that inflation is “elevated” while blaming that on continued supply chain issues that Biden's 'Transporation' secretary, Pete Buttigieg, has done nothing to solve, and higher prices for everything from gas and diesel fuel to food, housing materials and rent.

The outlet reports:

The efforts to bring down inflation are not without risks. The U.S. economy is teetering on the brink of a recession as inflation slows consumer purchases and dents business activity.

First-quarter GDP declined by 1.6% annualized, and markets were bracing for a reading on the second quarter to be released Thursday that could show consecutive declines, a widely used barometer for a recession.

To that end, the lame Biden regime is attempting to redefine the long-held previous definition of a recession.

"That’s not the technical definition," Treasury Secretary and 'economist'

Janet Yellen told NBC News' Chuck Todd this week. "There is an organization called the National Bureau of Economic Research that looks at a broad range of data in deciding whether or not there is a recession. And most of the data that they look at right now continues to be strong. I would be amazed if they would declare this period to be a recession, even if it happens to have two quarters of negative growth.

Even the pro-Democrat partisans at

CNN aren't letting the White House get away with that,

per Fox News.

On "The Lead," CNN anchor Kasie Hunt began a discussion on Tuesday by telling the panel she's "struggling" with what the Biden regime is putting out for an explanation.

"I get that why they want to do it from a political perspective, but like, you can't fake this!" Hunt exclaimed.

CNN editor at large Chris Cillizza, meanwhile, mocked Biden for saying "We're not going to be in a recession, in my view" during an exchange with Fox News' Peter Doocy. He told Hunt, "'In my view,' I should be drafted into the NBA."

"It doesn't really matter what you think," Cillizza said. "There is a technical definition, two straight quarters of negative economic growth. They clearly believe that is likely to come to pass later this week. They’re trying to pre-but it."

Nothing this administration has done has gone right.

Sources include:

FoxNews.com

WhiteHouse.gov

CNBC.com

Parler

Parler Gab

Gab