Parler

Parler Gab

Gab

ESG is about money; loans given out by top banks and foundations to companies that meet the guidelines of “stakeholder capitalism.” Companies must show that they are actively pursuing a business environment that prioritizes woke virtues and climate change restrictions. These loans are not an all prevailing income source, but ESG loans are highly targeted, they are growing in size (for now) and they are very easy to get as long as a company is willing to preach the social justice gospel as loudly as possible.

Deloitte's Insights studies show that ESG assets compounded at 16% p.a. between 2014 and 2018, now account for 25% of total market assets, and they believe that ESG could account for 50% of market share globally by 2024.

These loans become a form of leverage over the business world – Once they get a taste of that easy money they keep coming back. Many of the loan targets attached to ESG are rarely enforced and penalties are few and far between. Primarily, an ESG funded company must propagandize, that is all. They must propagandize their employees and they must propagandize their customers. As long as they do this, that sweet loan capital keeps flowing.

It's enough to keep corporations addicted, but not enough to keep them satiated. Diversity hiring quotas based on skin color and sexual orientation rather than merit help make the overlords happy. Pushing critical race theory smooths the way for more cash. Carbon controls and climate change narratives really makes them happy. And, promoting trans-trenders and gender fluidity makes them ecstatic. Each participating company gets it's own ESG rating and the more woke they go, the higher their rating climbs and the more money they can get.

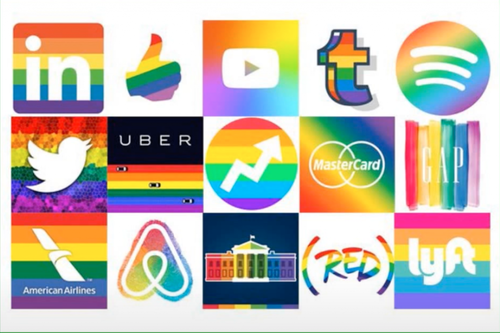

The list of companies heavily involved in ESG includes some of the largest in the world, with influence over thousands of smaller businesses. The ESG rating system is much like the social credit scoring system used in communist China to oppress the citizenry. The tactic is pretty straightforward – Banking elites are centralizing control of social narratives by incentivising businesses to embrace social justice and globalist ideals. They control who gets the money and anyone who doesn't play ball will be at a distinct disadvantage compared to companies that do.

They figure, if the corporate world can be pushed to go full woke, then this will trickle down to the general public and influence our behaviors and thinking. Except, it hasn't exactly worked out that way. Resistance to woke propaganda is growing exponentially and many of these companies are losing a huge portion of their customer base. They cannot survive on ESG alone.

The thing is, even ESG money has limits.

With central banks around the world now raising interest rates these kind of loans will become more expensive and will likely start to phase out. This is why the most woke corporations out there are also some of the most desperate for revenues this year, and why many of these companies are edging closer and closer to mass layoffs. The venture capital is gone and the ESG money is going to dry up also unless rates go back to zero and the bailout firehose is turned back on. Getting woke was once a backdoor tactic of gaining easy wealth. Now, getting woke really does mean going broke.

Read more at: ZeroHedge.com

ESG is about money; loans given out by top banks and foundations to companies that meet the guidelines of “stakeholder capitalism.” Companies must show that they are actively pursuing a business environment that prioritizes woke virtues and climate change restrictions. These loans are not an all prevailing income source, but ESG loans are highly targeted, they are growing in size (for now) and they are very easy to get as long as a company is willing to preach the social justice gospel as loudly as possible.

Deloitte's Insights studies show that ESG assets compounded at 16% p.a. between 2014 and 2018, now account for 25% of total market assets, and they believe that ESG could account for 50% of market share globally by 2024.

These loans become a form of leverage over the business world – Once they get a taste of that easy money they keep coming back. Many of the loan targets attached to ESG are rarely enforced and penalties are few and far between. Primarily, an ESG funded company must propagandize, that is all. They must propagandize their employees and they must propagandize their customers. As long as they do this, that sweet loan capital keeps flowing.

It's enough to keep corporations addicted, but not enough to keep them satiated. Diversity hiring quotas based on skin color and sexual orientation rather than merit help make the overlords happy. Pushing critical race theory smooths the way for more cash. Carbon controls and climate change narratives really makes them happy. And, promoting trans-trenders and gender fluidity makes them ecstatic. Each participating company gets it's own ESG rating and the more woke they go, the higher their rating climbs and the more money they can get.

The list of companies heavily involved in ESG includes some of the largest in the world, with influence over thousands of smaller businesses. The ESG rating system is much like the social credit scoring system used in communist China to oppress the citizenry. The tactic is pretty straightforward – Banking elites are centralizing control of social narratives by incentivising businesses to embrace social justice and globalist ideals. They control who gets the money and anyone who doesn't play ball will be at a distinct disadvantage compared to companies that do.

They figure, if the corporate world can be pushed to go full woke, then this will trickle down to the general public and influence our behaviors and thinking. Except, it hasn't exactly worked out that way. Resistance to woke propaganda is growing exponentially and many of these companies are losing a huge portion of their customer base. They cannot survive on ESG alone.

The thing is, even ESG money has limits.

With central banks around the world now raising interest rates these kind of loans will become more expensive and will likely start to phase out. This is why the most woke corporations out there are also some of the most desperate for revenues this year, and why many of these companies are edging closer and closer to mass layoffs. The venture capital is gone and the ESG money is going to dry up also unless rates go back to zero and the bailout firehose is turned back on. Getting woke was once a backdoor tactic of gaining easy wealth. Now, getting woke really does mean going broke.

Read more at: ZeroHedge.com

BIG market for Big Pharma: Survey finds 22% of US kids are OBESE

By Mary Villareal // Share

Journalist who warned about COVID jabs says White House officials targeted him for censorship

By News Editors // Share

Disney set to push more LGBTQ propaganda on children

By News Editors // Share

Corporate media to peasants: ‘Be a climate hero, kill yourself’

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share