Parler

Parler Gab

Gab

RBNZ's policy committee considers raising interest rates by 100 bps

The policy committee actually considered raising interest rates by as much as 100 bps, record of the meeting showed. The bank predicted that the economy would contract for four consecutive quarters beginning the second quarter of next year. It forecasted annual inflation will increase to 7.5 percent in the last quarter of this year from 7.2 percent. Consumer-price gains are expected to slow to five percent by the end of 2023. The RBNZ's updated predictions show the OCR gradually decreasing from late 2024. "The committee agreed that to achieve its remit objectives, actual and expected inflation need to decline substantially," the RBNZ said. The RBNZ's 75 bps increase isn't exactly surprising as several analysts and traders anticipated it. Still, the huge jump goes against the recent trend of central banks pivoting to a more dovish stance. For example, the Reserve Bank of Australia only increased 25 bps in its last meeting. Experts are also surprised that the RBNZ didn't even try to soften the effect of the 75-bps increase with some dovish remarks. Instead, the message was totally aggressive, hinting many more increases to come. "Its projections point to a peak of 5.5 percent by the middle of next year, a massive upgrade from the 4.1 percent peak that was projected in the August Monetary Policy Statement. And moving 'at pace' remains the watchword – a literal read of the published OCR track would require another 75-basis point hike at the next review in February, and a further 50 basis points in April," Westpac noted. The RBNZ anticipates persistently high inflation to continue and even soar to 7.5 percent over the next two quarters. These aren't the conditions supportive of a pivot and the bank are responding in the most direct way possible – by raising rates again and again. Follow MoneySupply.news for more news about central banks raising interest rates. Watch the video below to know why central banks around the world are hiking interest rates. This video is from the Chinese taking down EVIL CCP channel on Brighteon.com.More related articles:

Japan's central bank won't hike interest rates amid highest inflation in 40 years. Turkey's inflation hits 24-year high, but Erdogan insists there's no need to raise interest rates. Federal Reserve expected to raise interest rates earlier than expected due to rapid inflation. Fed interest rate hikes make living in overpriced America even MORE expensive. Sources include: Reuters.com TheStar.com ExchangeRates.org.ukApple speeds up plans to shift production OUT OF CHINA

By Arsenio Toledo // Share

Will UK egg shortages blamed on “avian flu” eventually come to North America?

By Ethan Huff // Share

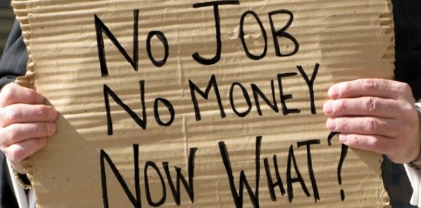

Runaway inflation driving some desperate Welsh citizens to eat pet food

By Ethan Huff // Share

Corporate America fires 13% of workforce, creates fewer jobs amid recession fears

By Belle Carter // Share

Unemployment in Germany continues to increase, government data show

By Ramon Tomey // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share