Parler

Parler Gab

Gab

Morgan Stanley, one of the few remaining dollar bulls, downgrade its outlook for the US currency citing declining Treasury yields following the Fed's dovish pivot https://t.co/tWxOtS16uF

— Bloomberg Markets (@markets) January 4, 2024

It was just a few months ago that credit ratings agency Fitch also downgraded the U.S. Dollar.... Remember that?? the Dollar ? printing machine come with a heavy toll: Morgan Stanley shifts U.S. dollar outlook from ‘Bullish’ to ‘Neutral’. Federal Reserve’s interest rate cuts cited as a key reason, impacting U.S. Treasury yields. #USD#Financepic.twitter.com/rgLJWyGmUp

— 2CentsPro (@2Centspro) January 5, 2024

U.S. Dollar DOWNGRADED Due To "Governance Deterioration"

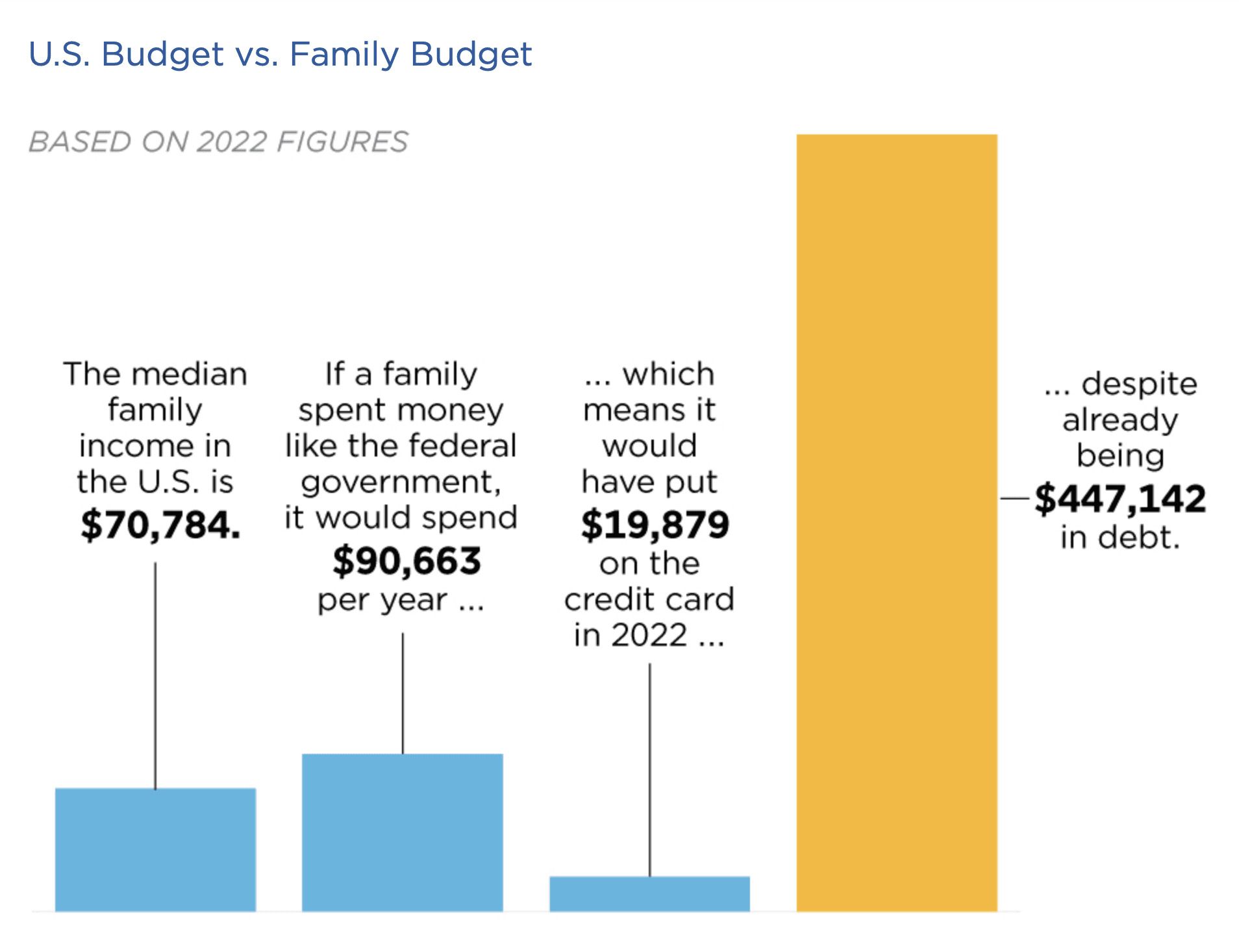

Something big happened yesterday and you might have missed it amidst all the Trump Arraignment coverage. In fact, it was something we've been warning you about for a long time. Specifically, Bo Polny has been telling you for almost two years now that the Dollar is about to CRASH. When he first said it people thought he was crazy. Now? Now it doesn't look so crazy, not at all. Especially not in light of what just happened yesterday. Credit Rating Agency Fitch just DOWNGRADED the U.S. Dollar.And in case your eyes just glazed over a bit because you don't know what all of this means, let me make it very simple for you... Have you ever bought a car or a house? What does the bank look at before they give you a loan? Your Credit Score. Well, just like you have a Credit Score the United States also has a credit score. And that Credit Score just went down. That really shouldn't be any big surprise because this chart (based on 2022 numbers) shows you how the U.S. Government is managing its budget -- as compared to a Family Budget. So it takes the ratios of the U.S. Government spending and budget and it puts those into how it would look for a family earning the Median Income in the U.S. The results are stunning:Dollar shaky after US credit rating downgrade https://t.co/du4oaIoooGpic.twitter.com/8Ep3csMcyn

— Reuters (@Reuters) August 2, 2023

Would a bank give a loan to someone with these numbers?

No way.

Not in a million years.

So...why do other countries still trust the U.S. Dollar?

Simple, only one reason: "the full faith and credit of the U.S. Government".

In other words, investors and other countries trust that the U.S. Government will always pay its bills -- somehow.

And so far that's true, the U.S. Government has never defaulted.

But the minute that confidence and trust in the U.S. Government goes away?

BOOM -- you'll have an instant and sharp crash of the U.S. Dollar.

And that's why this downgrade is so important.

Because they cite "governance deterioration" as one of the main reasons:

Would a bank give a loan to someone with these numbers?

No way.

Not in a million years.

So...why do other countries still trust the U.S. Dollar?

Simple, only one reason: "the full faith and credit of the U.S. Government".

In other words, investors and other countries trust that the U.S. Government will always pay its bills -- somehow.

And so far that's true, the U.S. Government has never defaulted.

But the minute that confidence and trust in the U.S. Government goes away?

BOOM -- you'll have an instant and sharp crash of the U.S. Dollar.

And that's why this downgrade is so important.

Because they cite "governance deterioration" as one of the main reasons:

Simply put: we now have LESS faith and confidence that the U.S. Government will actually pay its bills in the future because the country is being run so terribly! Hello Joe Biden! Kevin O'Leary confirms it's bad -- "There's no way to sugarcoat this." Interestingly, the U.S. Credit Rating has only been cut one other time in history. Care to guess when that was? 2011. When Joe Biden was Vice President and Barack Hussein Obama was busy destroying this country in much the same way that Joe is doing right now. Reuters has more details:Fitch has downgraded #US#credit rating over fiscal and governance deterioration, dealing a serious blow to US’ global reputation and standing. The downgrade may also be a part of the gradual decline of the US #dollar system, analysts said. https://t.co/hddzja0wF2pic.twitter.com/aMcGxHswOV

— Global Times (@globaltimesnews) August 2, 2023

The dollar rose on Wednesday as investors shrugged off Fitch's U.S. credit rating downgrade while data showing a larger-than-expected increase in private payrolls in July bolstered the greenback as it points to labor market resilience. Private payrolls rose by 324,000 jobs last month, the ADP National Employment report showed, more than an increase of 189,000 that economists polled by Reuters had forecast. The U.S. labor market is gradually slowing after the Federal Reserve's hiking of interest rates by 525 basis points since March 2022. But the economy remains strong, as indicated by the Atlanta Fed's GDPNow running estimate of real GDP growth for the third quarter at 3.9%. "The dollar is likely rising more in response to the economic data that continues to be stronger and therefore the market thinks that the Fed will continue to raise rates," said Michael Arone, chief investment strategist for State Street Global Advisors in Boston. "Those interest rate differentials compared to other countries will continue to expand or be strong," he said. "The dollar is getting a rally, in conjunction with a little bit of flight to safety." The dollar index , a measure of the U.S. currency against six peers, rose 0.57% to a fresh three-week high. The dollar index has gained 3.0% from a 15-month low on July 18. Fitch on Tuesday downgraded the United States to AA+ from AAA in a move that drew an angry response from the White House and surprised investors, coming despite the resolution two months ago of a debt ceiling crisis.So...what happens next? Bank crashes and "BAIL INS". That's what I expect to happen. Ever heard of a "Bail In"? Let me explain...

SPECIAL ALERT: Here Come Bank "Bail-Ins"!

You've heard of bank bailouts. We all learned about those back in 2008/09. And last weekend. But there's something new they're going to roll out this time around....Bank Bail-INS. Why bail out a bank with money from Congress if you can just take the money right out of your existing bank account! Gee, what a novel concept! In other words, this:That's a funny clip, but this is no laughing matter. This is very real. And once again I'm warning you that it's coming before it happens....so maybe you can protect yourself! It's not just me and my crazy ideas....here is one of the top financial YouTubers, Meet Kevin, talking about it: And my man, Patrick Bet David too from just a few days ago: Now check this out.... Video has leaked from closed door Fed meetings where they talk about how they can't possibly warn the public (i.e. we can't tell the public the truth!) because it will lead to mass hysteria. Stunning. They won't tell you the truth, but we will. Watch this:The 2010 Obama-era Dodd-Frank Act, claims to ‘PROTECT’ your money by allowing banks to STEAL it through a process called ‘bank bail-ins'.

Unfortunately, it looks like we might all become EXPERTS on this in the weeks to come. pic.twitter.com/LoiTDRZ9Yy — Epstein's Sheet. ? (@meantweeting1) March 11, 2023

More here:HOLY CRAP!

??FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out. "I completely agree...you can't tell the public about this, they would… pic.twitter.com/0dSFYQYWVT — DailyNoah.com (@DailyNoahNews) March 19, 2023

Why Bank Bail-Ins will be the new bailouts: https://twitter.com/VersanAljarrah/status/1616842617026658305 It's coming:??FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out. "You don't want a huge run on the institutions, and, and they're going to be… (?) pic.twitter.com/K8yaM8jzta — Angelus caelis ?? (@caelisangelus) March 11, 2023

ChatGPT knows EXACTLY what they are:Body Language: FDIC Bank BAIL-INs pic.twitter.com/6IFodaGy5D

— ʙᴏᴍʙᴀʀᴅꜱ ✝️? (@BombardsBL) December 30, 2022

Bank bail-ins are a method of resolving a failing bank's financial difficulties by requiring the bank's shareholders and creditors to contribute to the bank's recapitalization, rather than relying solely on taxpayer funds. In a bail-in, the bank's creditors, including bondholders and depositors with balances over a certain threshold, may have a portion of their holdings converted into equity in the bank or written off completely. This approach is intended to protect taxpayers from having to bail out a failing bank, and instead puts the burden on the bank's investors and creditors to bear the losses. Bail-ins are generally seen as a way to increase the accountability of banks and their investors, and to create incentives for banks to operate more prudently and manage risks more effectively. Bail-ins have been implemented in various countries as part of financial regulatory reform efforts following the global financial crisis of 2008-2009. The European Union, for example, introduced a bail-in framework in 2014 that requires failing banks to first use their own funds and resources to address their financial difficulties before seeking public support.Translation of that bold part: say you had $100,000 in a bank account. One day they just decide a "bail in" is necessary and now you have $50,000. Or $25,000. But they will thank you for doing your patriotic duty! Wow, not me folks! No way. I'm going Crypto and Gold & Silver. That's just me, but I like my money where the thieves can't just take it! Here's more:

Of course the Government is telling you NOT to withdraw your funds....they're safe!Everything you need to know about bank bail-ins. Convenient timing considering what's happening at #Silvergate$SIpic.twitter.com/qrmvfREIDN

— Nobody Special (@JG_Nuke) March 2, 2023

Look, I can't tell you what to do, I'm not a financial advisor. But me personally? I have a big chunk of my assets in crypto and another big chunk in precious metals. I keep as little as possible in the banks. That's just what helps me sleep best at night. Here's more on gold:"Don't withdraw your money from the bank" The countdown to bank bail-ins just began. https://t.co/M4P1co2y9N

— Erik Voorhees (@ErikVoorhees) March 24, 2020

Here's Why Central Banks Are Buying All the Gold They Can -- And What YOU Can Do!

For the last year, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why. The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the "elites" and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals. If you've been waiting for me to bring you a solution about what YOU can do to protect yourself and you're family, I'm happy to introduce you to something I absolutely love! Precious metals. I just talked about precious metals this week with Bo Polny and now I'm bringing you a solution that you can utilize right away if you're so inclined... A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site. Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer "virtual" or "paper" gold or silver. With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door. Central bankers aren't slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it's understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store. Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company. Visit genesiswlt.com or call 866-292-0443 today. Don't wait too long, we might have more bank failures right around the corner. You know what has NEVER "failed"? Gold. Precious metals. Indestructible. There's a reason they call it "God's money". Watch this for more: Read more at: WLTReport.comTrump vows to prevent the Federal Reserve from creating an American CBDC

By Arsenio Toledo // Share

The catalyst for the next US civil war?

By News Editors // Share

The US government has lost all legitimacy with its increasingly psychotic behavior

By News Editors // Share

NBC News: Inflation and illegals to blame for HOMELESSNESS among LA students

By Ava Grace // Share

Central banks will keep gobbling gold in 2024

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share