Parler

Parler Gab

Gab

BLS DATA: U.S. payroll gains are also not as robust as reported

The revelations about California's labor market are not isolated. BLS in June, the Quarterly Census of Employment and Wages (QCEW) suggests that payroll growth in the United States last year was significantly lower than previously reported. The QCEW data – covering over 95 percent of U.S. jobs – shows an average monthly increase of approximately 190,000 jobs. In contrast, monthly employment reports from the BLS indicated an average payroll growth of around 250,000 jobs per month. "There’s a pretty good chance that the establishment survey has been really overstating the condition of the labor market," Barry Knapp, founder of investment strategy firm Ironsides Macroeconomics, said of the monthly payroll numbers. "The job market is weaker than the Fed thinks." Anna Wong, the chief U.S. economist at Bloomberg Economics, made a similar statement: "The Fed could be late to cut rates – cutting only when the labor market already is far into a downward spiral." Moreover, a subsequent monthly employment report, which showed payroll growth of about 185,000 for May, following an increase of 175,000 in April, based on a Bloomberg survey, is derived from a study of approximately 119,000 businesses and government agencies. However, the QCEW data, based on unemployment insurance tax records from over 12 million establishments, presents a different narrative. The payroll numbers are typically revised each February to align with the QCEW data, with initial revision estimates provided in August. Both Wong and Knapp attribute much of the potential overestimation in payrolls to adjustments made by the BLS to account for the net effect of business openings and closures. The BLS employs a "birth-death model" to estimate these flows, which may not accurately capture the dynamics of the current economic environment. "The labor market saw a turning point sometime in the second half of 2023," Wong said. "Business closures surged, while new business formations slowed sharply." Meanwhile, Knapp stressed that small businesses are particularly susceptible to high interest rates, making them more likely to close, a factor that the monthly payroll survey might not fully capture. Head over to CaliforniaCollapse.news for more stories related to the Golden State. Watch this clip from InfoWars as Robert Barnes and George Gammon talk about the true dangers of inflation and the U.S. Federal Reserve's money-printing practices. This video is from the InfoWars channel on Brighteon.com.More related stories:

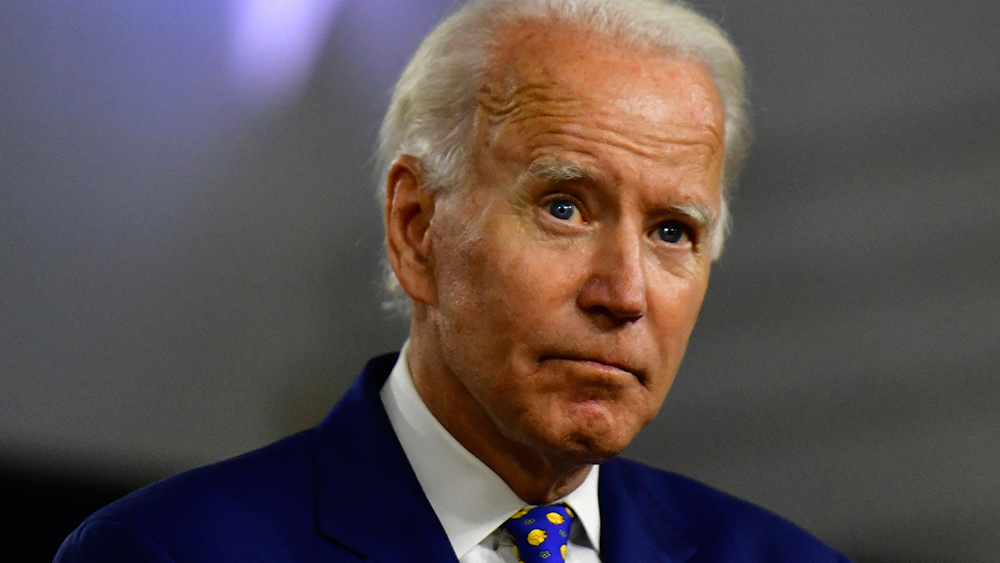

Job replenishment – migrants secured 75% of ALL new jobs under Biden. Japan accepted a record high of 303 asylum seekers in 2023 but REJECTED 98% of applicants. High unemployment rates, high taxes and population exodus pushing Illinois to the brink of collapse. Biden’s economic record tied to illegal migrant employment surge, says report. Interest rate hikes caused 5.8 increase in Canada’s UNEMPLOYMENT rate, survey reveals. Sources include: ZeroHedge.com Bloomberg.com Brighteon.comMainstream media claims Biden is still “sharp” at 81, just “forgetful”

By Belle Carter // Share

Israel says Doctors Without Borders staffers are terrorists who deserve to be killed

By Belle Carter // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share