Parler

Parler Gab

Gab

- President Trump plans to restructure international debt via the Mar-A-Lago Accord, converting foreign-held U.S. Treasury debt into ultra-long-term securities to reduce annual debt service payments and mitigate financial crisis risk.

- The Accord, named after Trump’s Florida estate, aims to manage the $31 trillion U.S. national debt by converting short-term and medium-term Treasury bonds into 50-year Treasury bills, lowering the annual interest burden.

- Tariffs are used as a coercive tool to ensure compliance with the Accord, targeting China and Europe, which hold significant U.S. debt, to pressure them into accepting the new debt structure.

- The Accord has significant geopolitical implications, potentially leading to economic and political fallout, especially with China, which may resist the deal, and Europe, facing a tough choice between compliance and economic disruption.

- The plan includes a potential revaluation of gold to back the new long-term Treasury securities, which could see gold prices surge to 20,000 − 25,000 per ounce, stabilizing the U.S. dollar and restoring global financial confidence.

The role of tariffs as a coercive tool

To ensure compliance with the Mar-A-Lago Accord, Trump is leveraging tariffs as a powerful coercive tool. The recent imposition of tariffs on China and Europe is seen as a strategic move to pressure these countries into accepting the new debt structure. China, which holds approximately $867 billion in U.S. Treasury debt, is a primary target. By threatening to impose or increase tariffs, Trump aims to convince China to roll over its debt into long-term Treasury securities. Similarly, European countries, which collectively hold substantial U.S. debt, are also being targeted with tariffs to ensure their cooperation.The geopolitical fallout

The implications of the Mar-A-Lago Accord extend beyond the financial realm and into the geopolitical arena. The use of tariffs as a bludgeon to force compliance raises concerns about potential economic and political fallout. China, in particular, is unlikely to accept this deal without resistance. The country has been increasingly assertive on the global stage and may choose to retaliate, potentially leading to a more severe trade war or even broader economic conflict. Europe, too, faces a difficult choice: comply with the U.S. demands or risk significant economic disruption.The gold revaluation hypothesis

Another key aspect of the Mar-A-Lago Accord is the potential revaluation of gold. Financial experts like Jim Rickards have suggested that a gold revaluation could be necessary to back the new long-term Treasury securities. This revaluation could see the price of gold skyrocket to between 20,000 and 25,000 per ounce. The reattachment of gold to the dollar would provide a more stable foundation for the U.S. currency and could help restore confidence in the global financial system. The global gold shortage is a critical factor in this equation. With central banks and investors alike scrambling for physical gold, the demand far outstrips the supply. This shortage is driving up prices and creating a sense of urgency among nations to secure their gold reserves. The Mar-A-Lago Accord could be seen as a pre-emptive move to secure the U.S. position in a world where gold is once again a crucial asset.Conclusion

The Mar-A-Lago Accord represents a bold and potentially risky strategy to restructure U.S. debt and stabilize the global financial system. While the plan could offer significant benefits, including reduced annual debt service payments and a revaluation of gold, it also carries the risk of economic and geopolitical instability. As the world watches, the coming days and weeks will reveal the true impact of this ambitious financial chess game. The stakes are high, and the outcome could redefine the economic order for generations to come. Watch this Feb.12 episode of "Brighteon Broadcast News" as Mike Adams, the Health Ranger, talks about Mar-A-Lago Accord confirms Trump is about to restructure the entire global currency and debt system. This video is from the Health Ranger Report channel on Brighteon.com.More related stories:

Trump’s bold move: Reshaping USAID could redefine U.S. foreign policy Massive gold transfer just took place between London and the New York Commodity Exchange The consumer financial protection bureau harms those whom it claims to protect Sources include: Brighteon.comTrump administration declares war on Mexican drug cartels, designates them as foreign terrorists

By Finn Heartley // Share

Crypto advocate challenges UK tax system to stop funding war crimes

By Finn Heartley // Share

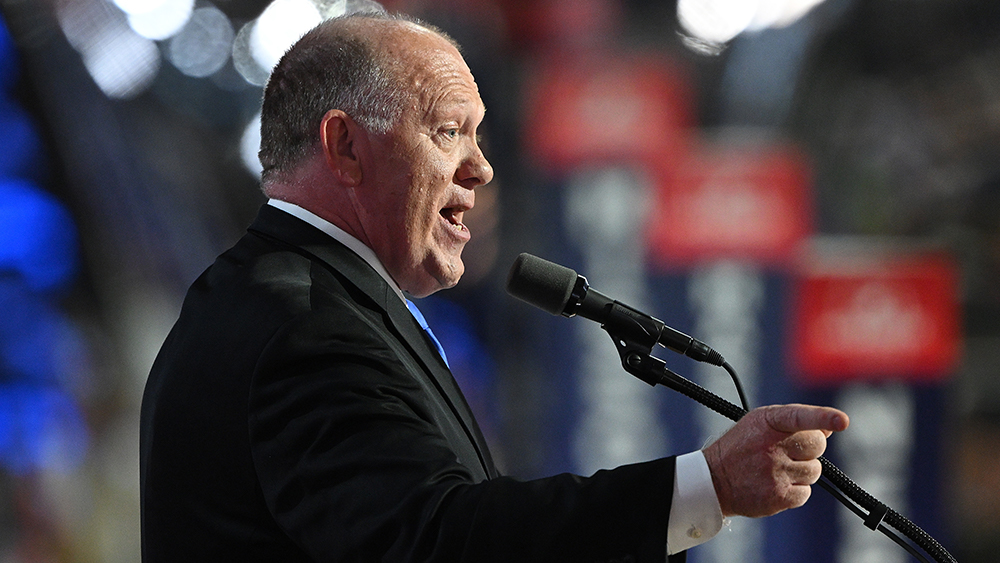

Steven Miller disembowels CNN when they try to defend government fraud

By News Editors // Share

SECURE BORDERS: Trump’s border czar reports historic low in illegal immigrant encounters

By Willow Tohi // Share

Trump declares war on DOJ corruption, orders immediate firing of all Biden-era attorneys

By Willow Tohi // Share

Trump voices out FRUSTRATION toward critics of his Ukraine peace plan, including Zelensky

By Ramon Tomey // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share