Parler

Parler Gab

Gab

- China controls 80% of global rare earth processing, while the U.S. lacks domestic refining capacity despite having reserves. Critical minerals (e.g., dysprosium, terbium) are vital for defense (F-35 jets) and tech (iPhones), making dependence a national security risk.

- President Donald Trump’s executive order imposed 145% tariffs on Chinese imports (excluding electronics), sparking retaliation.

- Full independence could take 5+ years, with a Pentagon goal of a mine-to-magnet supply chain by 2027. Experts warn China’s dominance (e.g., 300,000 tons vs. U.S.’s 1,300 tons) makes rapid scaling difficult.

- China’s 2025 export restrictions heightened pressure for U.S. action. Transitioning will mean short-term costs but is critical for long-term security. Analysts stress the U.S. must accelerate efforts to avoid being caught in a future supply crisis.

The urgency: China’s dominance and U.S. dependence

China controls roughly 80% of global rare earth processing, a monopoly solidified over decades. The U.S. imports most of its refined rare earth metals from China, leaving defense and tech sectors exposed to geopolitical disruptions. In response to Trump’s April 2 executive order imposing 145% tariffs on Chinese imports (excluding electronics), Beijing retaliated by restricting exports of dysprosium, terbium and five other critical minerals. The administration has 180 days to propose solutions, including deep-sea mining and stockpiling, but experts warn full independence could take five years or more. “If China bans the sale of rare earth minerals to the United States [permanently], that’s a positive thing because it’s going to force the United States to find a solution,” said economist Antonio Graceffo.Domestic projects: Progress, but a long road ahead

Several U.S. initiatives are underway to close the gap:- American Rare Earths (Wyoming & Arizona) – Developing a $456M refinery to process dysprosium and terbium.

- MP Materials (California & Texas) – Produced a record 45,000 metric tons of rare earth oxides in 2024 but still exports much of its ore to China.

- Lynas Rare Earths (Texas) – Awarded $258M by the Pentagon to build a heavy rare earths processing plant.

The catch: Permitting, financing and China’s scale

Despite investment, hurdles remain:- Permitting delays – Projects often take 10-20 years to approve.

- Lack of refining capacity – The U.S. still cannot process all mined ore domestically.

- Financing challenges – Rare earth mining is capital-intensive, and banks hesitate to lend.

A national security imperative

President Trump’s push for domestic rare earth production is a critical step in reducing reliance on China, but full independence remains years away due to lack of infrastructure. The Pentagon’s mine-to-magnet supply chain goal by 2027 is ambitious, yet experts agree: the effort is necessary to safeguard national security. As trade tensions escalate, the U.S. must balance short-term economic pain—such as higher costs during the transition—with long-term strategic benefits. One thing is clear: the era of unchecked dependence on Chinese rare earths is ending. The question is whether America can build a viable alternative before the next crisis hits. Sources for this article include: ZeroHedge.com TheEpochTimes.com WhiteHouse.govU.S. job market surges past projections despite looming tariff uncertainty

By Willow Tohi // Share

“Wartime Homefront Essential Skills” on BrightU: How AI could spark a global food crisis

By Jacob Thomas // Share

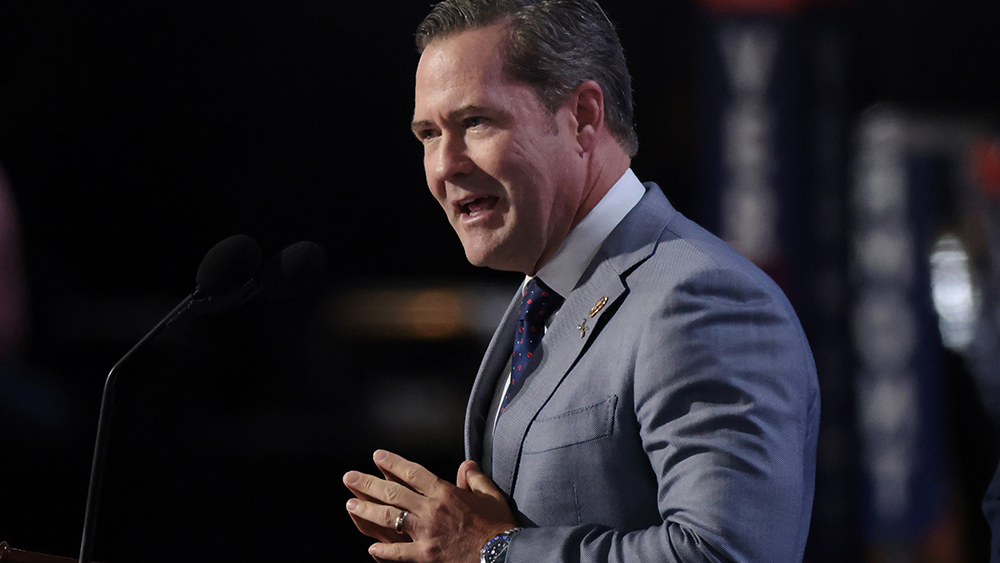

Trump taps Mike Waltz as next U.S. ambassador to the United Nations

By Laura Harris // Share

Mass protests erupt across China as Trump tariffs trigger economic crisis

By Laura Harris // Share

Trump’s tariffs on Chinese goods send Amazon sellers into panic

By Laura Harris // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share